In my early twenties, I was lamenting an unexpected car repair to my dad and his advice to me was “Andy, you’ll be paying for cars for the rest of your life: you can choose between a car payment or a repair bill.” This may be a bit of an oversimplification, but it changed something in my mind about how I perceived the total cost of vehicle ownership.

Fast-forward a few years and I had learned a bit more about budgeting but still found myself groaning with despair when my car insurance bill would arrive every six months. Even though it showed up like clockwork, I was failing to remember and account for it. Adding insult to injury, it always seemed to show up just when I had accumulated some padding in my bank account. These experiences compelled me to reinvent how I track my expenses, income, investments, and savings. After years of iteration and improvement, I’m pleased to share that I rarely experience “unexpected” expenses anymore.

The key is to put together a written budget that accounts for everything so you can see–at a glance–exactly where you stand and how much “room” you have (or don’t have) for new expenses.

The good news is there is no need for fancy budgeting apps that often want access to your credit card and bank accounts–all you need is a well-designed spreadsheet that handles all the math. I’ve written this post and a template spreadsheet to help others jump start their budgeting journey and perhaps avoid some of the mistakes I made along the way. This method focuses on developing a monthly budget since “the big things” (rent, car payments, etc.) tend to come around monthy–but also makes some accommodation for things like bi-weekly payroll deposits.

Disclaimer: I am not an accountant, and this is not professional financial planning advice.

Getting Started

Generally, you will need a checking and savings account with a bank or credit union. You’ll need a browser and a Google account for accessing a Google Sheets spreadsheet. Plan on using a desktop or laptop computer to make your initial budget. Later, you can open your budget spreadsheet from your phone for reference or minor edits. Let’s first review a few terms that are used throughout the process:

| Term | Definition |

|---|---|

| Daily | Every day |

| Weekly | Once per week |

| Bi-Weekly | Once every two weeks |

| Semi-Monthly | Twice per month |

| Monthly | Once per month |

| Semi-Yearly | Twice per year |

| Yearly | Once per year |

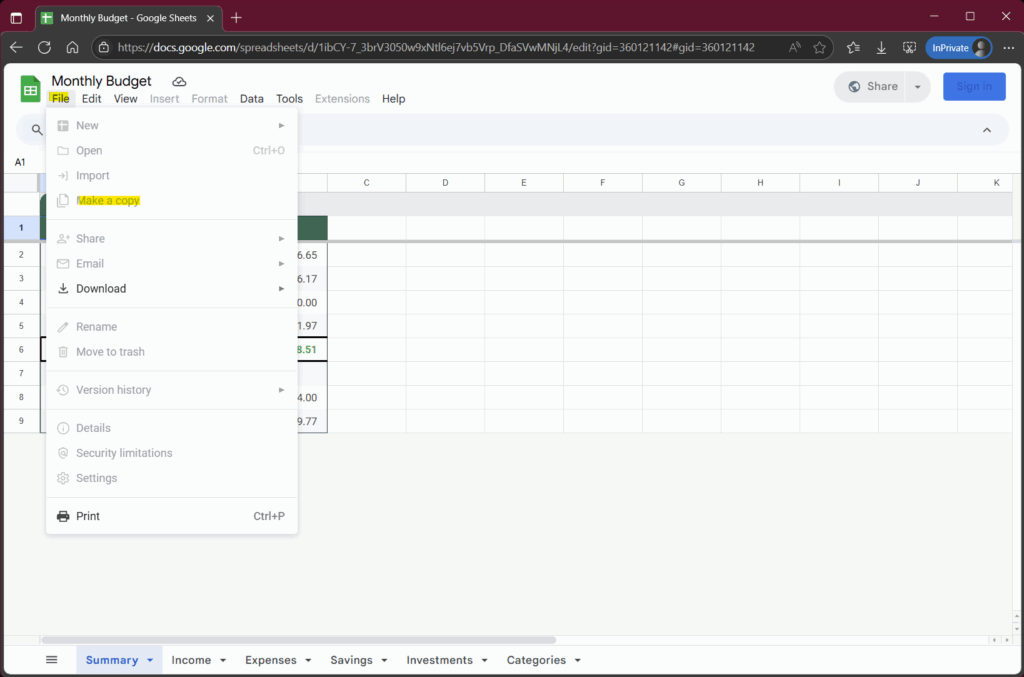

Now that we’re clear on these terms, open my Monthly Budget spreadsheet template in a new tab. Then click File > Make a copy to save an editable copy in your own Google Drive.

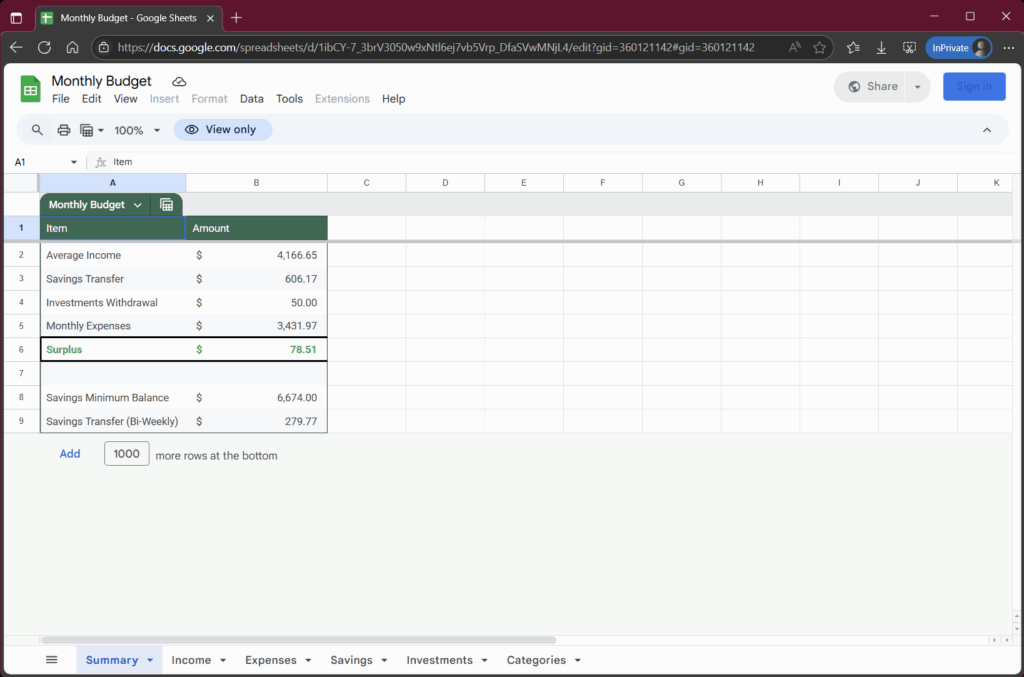

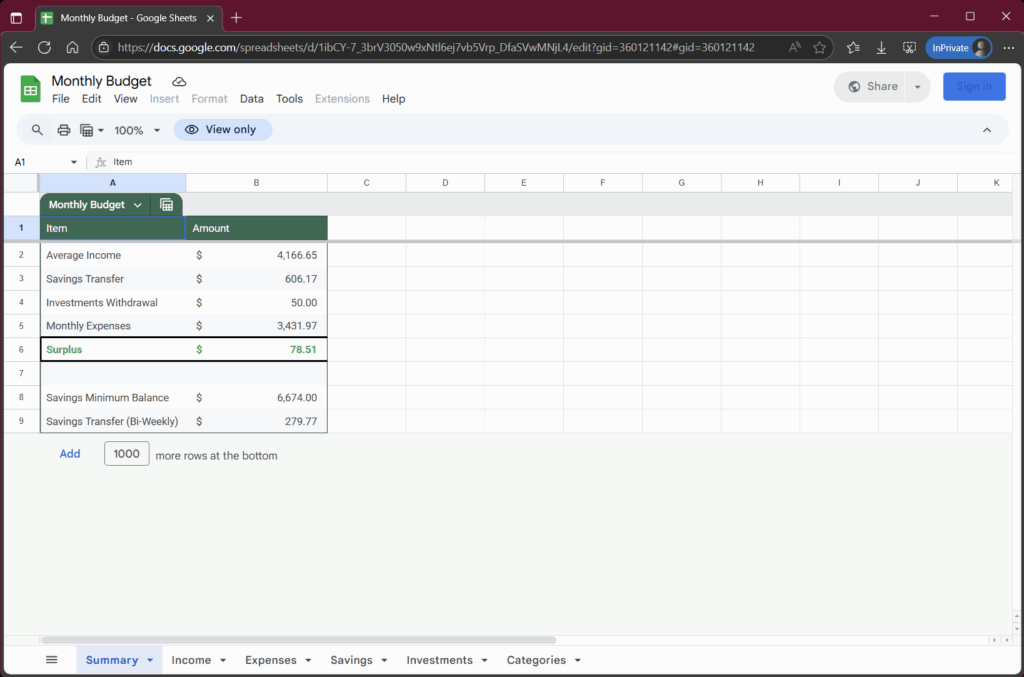

Summary Tab

The Summary tab provides an overview of your budget. For now, I will give a simple explanation–the contents of this tab will be more relevant once you’ve populated the others. It contains the following rows:

| Row | Comment |

|---|---|

| Average Income | This is the monthly average of all Income from all sources. |

| Savings Transfer | The amount to transfer to savings every month to cover all savings goals and investments and expenses that happen semi-yearly or yearly. |

| Investments Withdrawal | This is the sum of all investments that are withdrawn monthly. |

| Monthly Expenses | This is the sum of all expenses that are paid monthly, semi-monthly, bi-weekly, weekly, and daily. |

| Surplus/Deficit | This row will show Surplus or Deficit after subtracting savings, investments, and expenses from income. |

| Savings Minimum Balance | This is the amount you would need to have in savings if all of your semi-yearly and yearly expenses and investments withdrawals came due all at once. |

| Savings Transfer (Bi-Weekly) | This is the amount to transfer to savings if you are paid bi-weekly and want to align an automatic transfer with your payroll deposit. |

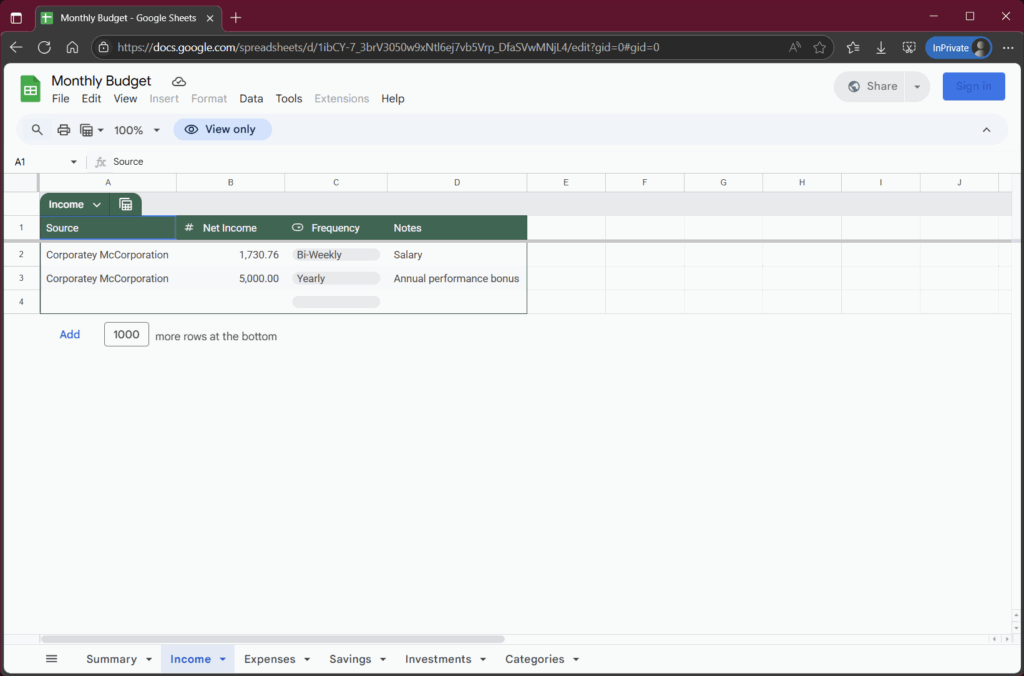

Income Tab

On the Income tab, you should add the Source, Net Income, and Frequency for each of your income sources. Note that net income means the amount you take home after taxes. If you are not paid regularly (as is the case with some sales and commission-based jobs), enter your best estimate.

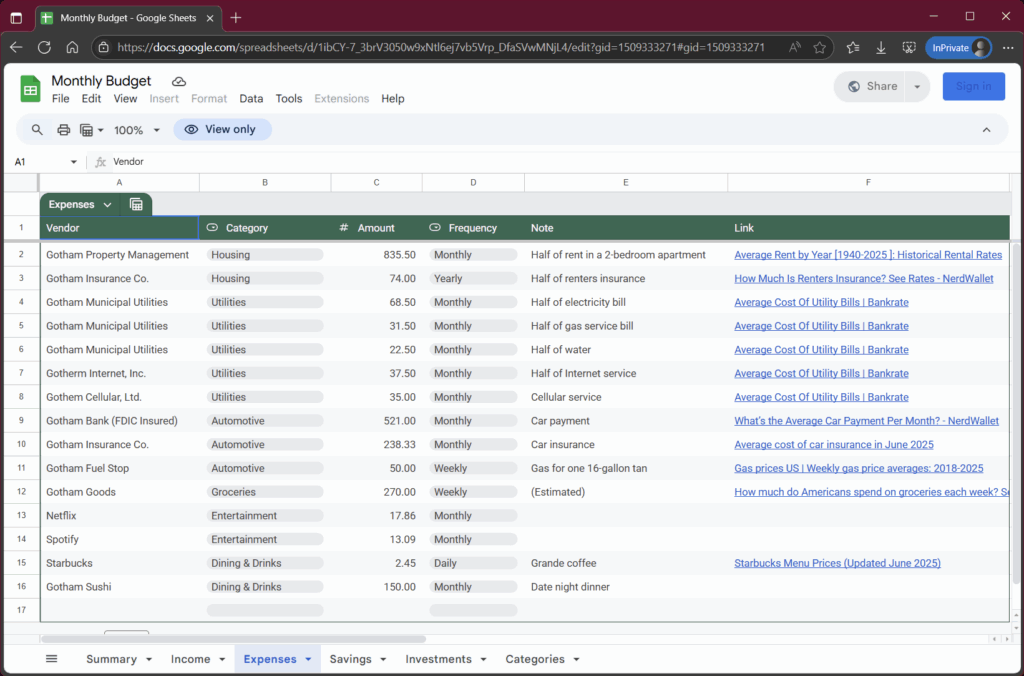

Expenses Tab

On the Expenses tab, enter a Vendor, Amount, and Frequency for every expense you can reasonably quantify–no matter how small! Optionally, you can also record a Category and Note for each if desired (these columns do not affect your budget calculation–they are there just to help you visualize your expenses). You can delete the Link column if you like–this contains the sources I used to come up with this example budget.

The sum of your daily, weekly, bi-weekly, semi-monthly, and monthly expenses are displayed on the Monthly Expenses row of the Summary tab. Your semi-yearly and yearly expenses are included in the calculation for the Savings row of the Summary tab. This is to help you set aside money each month for expenses that come around only once or twice a year–and is part of how we avoid “unexpected” expenses like that car insurance bill that took me by surprise time and again.

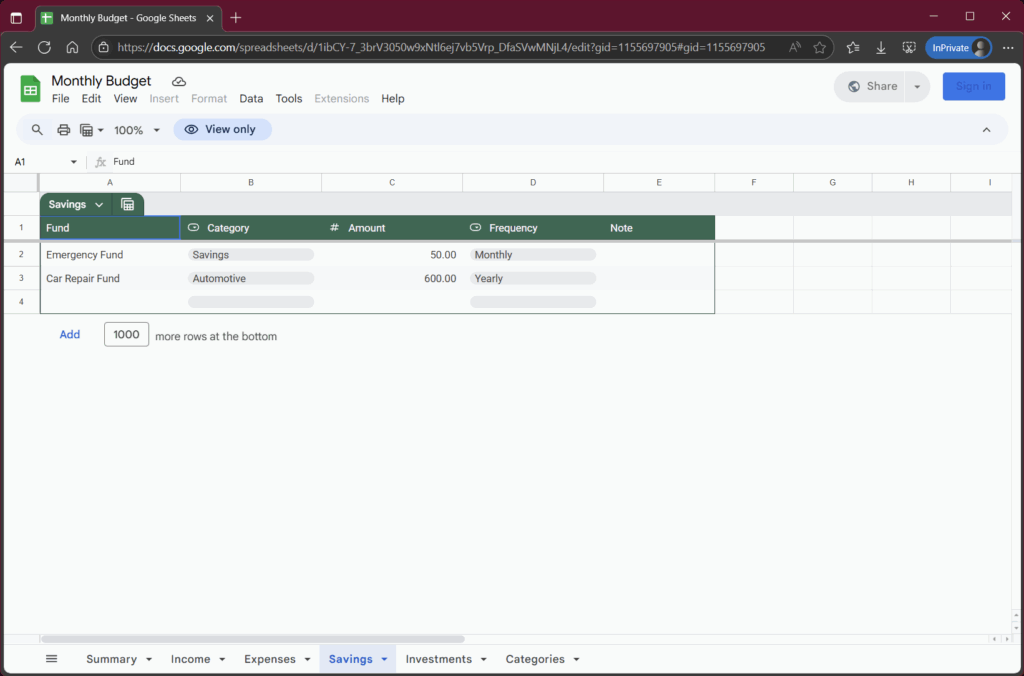

Savings

On the Savings tab, enter a Fund, Amount, and Frequency for each of your savings goals. As with expenses, you can optionally record a Category and Note for each. In this example, I have two savings goals–an emergency fund and a car repair fund. Take some time and think about the things that might come up for you. Here’s a few ideas:

- Pet/Vet Fund because those furry little bundles of joy always seem to develop a limp the moment you’re getting ahead on your bills.

- Technology Fund for replacing phones, computers, etc. which always seem to go belly-up at the worst possible time.

- Travel Fund to make sure you have funds to enjoy life.

- Entertainment Fund so when your favorite artist comes to town, you have some money set aside to buy the exorbitantly priced tickets.

The monthly average for everything on this tab will be included in the calculation for the Savings row on the Summary tab. You could consider setting up an automatic transfer to move this amount from your checking to your savings account every time you get paid.

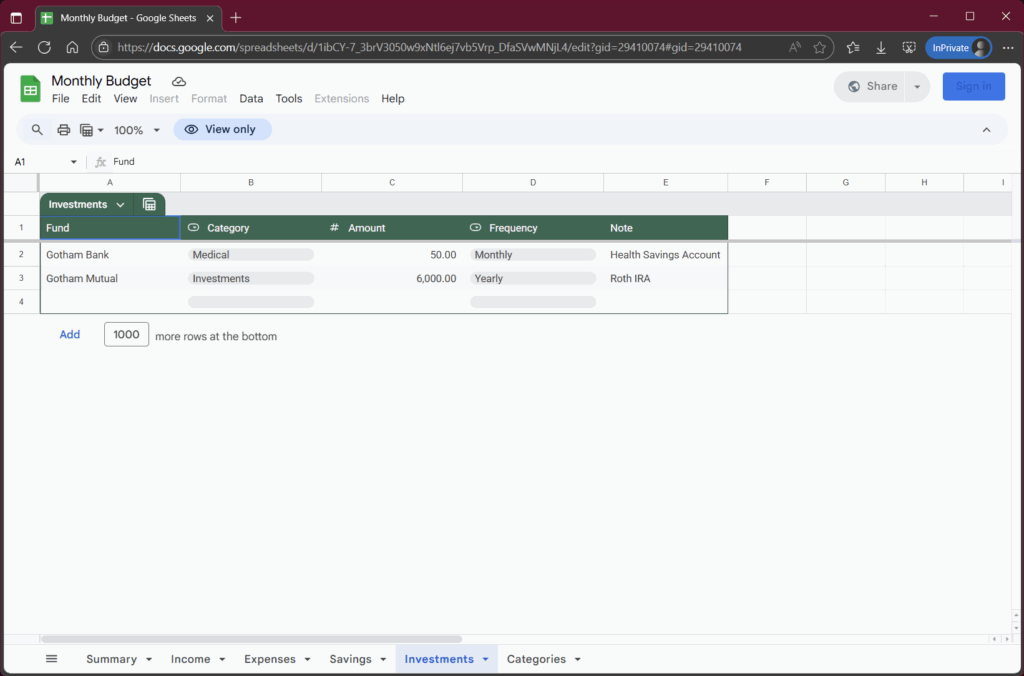

Investments Tab

On the Investments tab, enter a Fund, Amount, and Frequency for each of your investment contributions. As with expenses and savings, you can optionally record a Category and Note for each. Don’t enter anything here that is taken out of your paycheck before you are paid such as a company 401K account contribution. This tab is for investment contributions you make from your checking account to some investment product e.g., a Health Savings Account, Roth IRA, Mutual Fund, etc.

The sum of your daily, weekly, bi-weekly, semi-monthly, and monthly investment withdrawals are displayed on the Investments Withdrawals row of the Summary tab. Your semi-yearly and yearly investment withdrawals are included in the calculation for the Savings row of the Summary tab. These are handled the same way we handle semi-yearly and yearly expenses for the same reason–so when they come around, the money is already in your savings account.

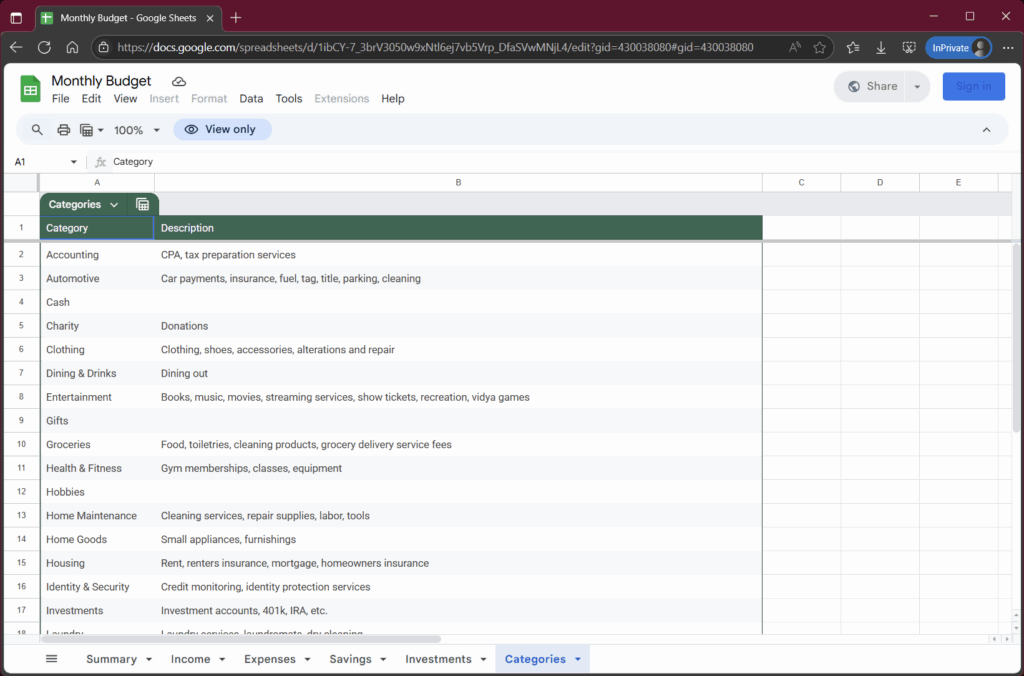

Categories Tab

As mentioned in expenses, savings, and investments, Category is optional but can be helpful in visualizing your budget. The choices for those Category columns comes from this sheet. You can add or remove Categories from this tab as needed to fit your budgeting needs. The ones listed here (and their corresponding descriptions) are suggestions taken from my experience.

Summary Tab, Again

Now that your intial budget is complete, head back to the Summary tab to hopefully see that the “bottom line” (row 6) shows a Surplus. If you have diligently populated all of the other tabs with every possible expense, savings goal, and investment item, this is the amount of your “unencumbered” funds that you can use for anything and everything else. Interested in subscribing to another streaming service? Wanting to go out for a fancy dinner? How about a much-needed spa treatment? This line tells you how much “room” you have for extras every month.

However, if you have an income shortfall / expenses overrun, you may see a Deficit instead:

If this is the case, you may have to make some hard choices about your expenses and/or savings goals, or may need to find a way to augment your income.

Let’s review the rows of this sheet with a little more detail than before:

| Row | Comment |

|---|---|

| Average Income | This is the monthly average of all Income from all sources. In the above example budget, the Income tab shows a monthly income and a yearly performance bonus. The number in this field reflects the average monthly income based on the total yearly income so if you have any semi-yearly or yearly income, the amount coming into your checking account each month will be less than this number. |

| Savings Transfer | This is the amount you would transfer from checking to savings every month to cover all savings goals and investments and expenses that happen semi-yearly or yearly. You might consider setting up an automatic transfer to move these funds from checking to savings a day or two after your employer deposits your paycheck to your account. |

| Investments Withdrawal | This is the sum of all Investments that are withdrawn monthly. |

| Monthly Expenses | This is the sum of all expenses that are paid monthly, semi-monthly, bi-weekly, weekly, and daily. |

| Surplus/Deficit | This row will show Surplus or Deficit after subtracting savings, investments, and expenses from income. |

| Savings Minimum Balance | This is the amount you would need to have in savings if all of your semi-yearly and yearly expenses and investments withdrawals came due all at once. Its important to realize that as you begin your budgeting journey, you may not have all the money you need in savings for upcoming expenses. You may not need this much in your savings at all times, but you could set a goal that your savings average daily balance is in this ballpark. |

| Savings Transfer (Bi-Weekly) | This is the amount to transfer to savings if you are paid bi-weekly and want to align a savings transfer with your payroll deposit. If you are content with a monthly transfer, you can ignore (or delete) this line. |